Short Call Expires In The Money . The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. Web selling the call obligates you to sell stock at strike price a if the option is assigned. Web in the money or out of the money? Web a short call is an options trading strategy that involves a trader selling (or writing) a call option with the expectation that the price of the underlying asset will. American style options (etfs and equities) are settled via. Web suppose an investor purchases a call option that is 13% out of the money and expires in one year for 3% of the value of the. When running this strategy, you want the call you sell to expire worthless. No transference of stock takes place. A call option 5 gives the.

from www.adigitalblogger.com

Web selling the call obligates you to sell stock at strike price a if the option is assigned. No transference of stock takes place. A call option 5 gives the. Web a short call is an options trading strategy that involves a trader selling (or writing) a call option with the expectation that the price of the underlying asset will. When running this strategy, you want the call you sell to expire worthless. Web suppose an investor purchases a call option that is 13% out of the money and expires in one year for 3% of the value of the. The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. Web in the money or out of the money? American style options (etfs and equities) are settled via.

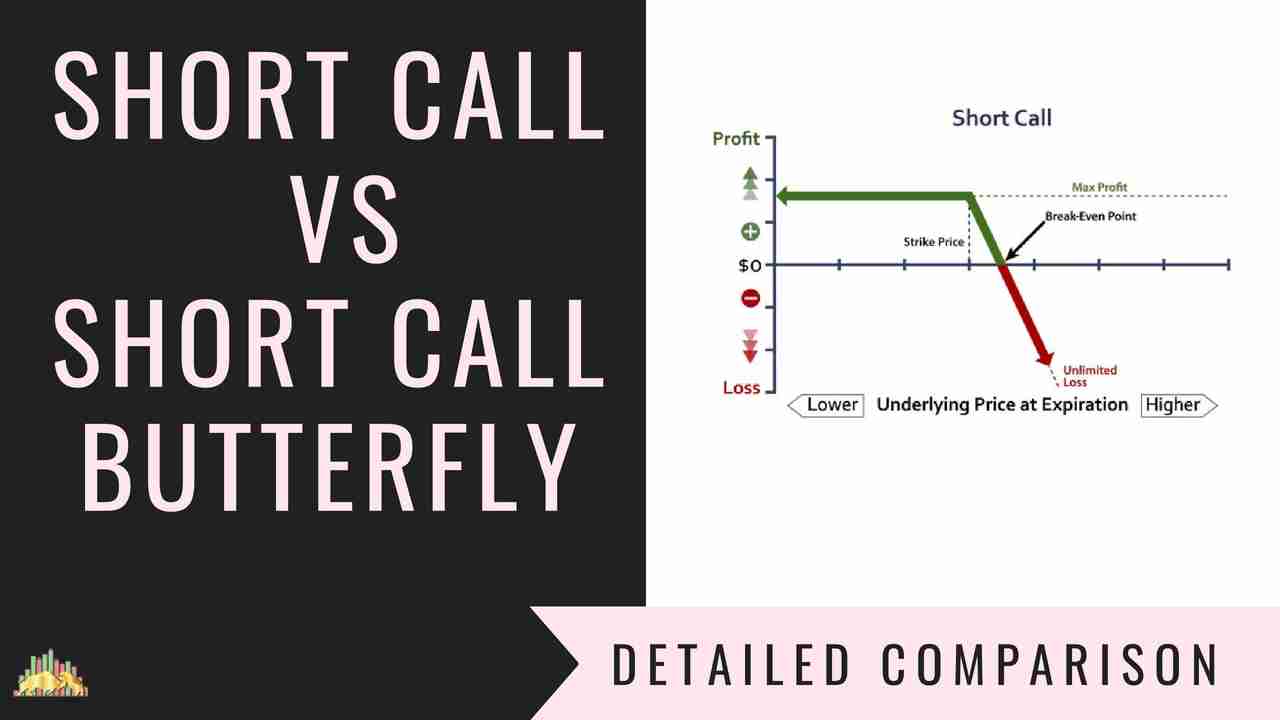

Short Call Vs Short Call Butterfly Options Trading Strategies Comparison

Short Call Expires In The Money The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. No transference of stock takes place. Web a short call is an options trading strategy that involves a trader selling (or writing) a call option with the expectation that the price of the underlying asset will. American style options (etfs and equities) are settled via. Web in the money or out of the money? Web selling the call obligates you to sell stock at strike price a if the option is assigned. When running this strategy, you want the call you sell to expire worthless. A call option 5 gives the. Web suppose an investor purchases a call option that is 13% out of the money and expires in one year for 3% of the value of the.

From www.projectfinance.com

Here’s What Happens When Options Expire InTheMoney projectfinance Short Call Expires In The Money Web a short call is an options trading strategy that involves a trader selling (or writing) a call option with the expectation that the price of the underlying asset will. No transference of stock takes place. A call option 5 gives the. When running this strategy, you want the call you sell to expire worthless. Web selling the call obligates. Short Call Expires In The Money.

From marketdigest.io

【投資概念】了解Short call與Long call分別!例子詳解Short call到期日意思 Market Digest Short Call Expires In The Money Web selling the call obligates you to sell stock at strike price a if the option is assigned. When running this strategy, you want the call you sell to expire worthless. American style options (etfs and equities) are settled via. No transference of stock takes place. Web suppose an investor purchases a call option that is 13% out of the. Short Call Expires In The Money.

From www.fishbowlapp.com

My call debit spread is in the money and expires t... Fishbowl Short Call Expires In The Money No transference of stock takes place. Web a short call is an options trading strategy that involves a trader selling (or writing) a call option with the expectation that the price of the underlying asset will. Web selling the call obligates you to sell stock at strike price a if the option is assigned. Web in the money or out. Short Call Expires In The Money.

From estably.com

Short Call Optionsstrategie einfach erklärt Short Call Expires In The Money A call option 5 gives the. Web in the money or out of the money? American style options (etfs and equities) are settled via. Web a short call is an options trading strategy that involves a trader selling (or writing) a call option with the expectation that the price of the underlying asset will. When running this strategy, you want. Short Call Expires In The Money.

From analystprep.com

profitofashortcalloption CFA, FRM, and Actuarial Exams Study Notes Short Call Expires In The Money Web in the money or out of the money? A call option 5 gives the. The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. American style options (etfs and equities) are settled via. No transference of stock takes place. Web selling the call obligates you to sell stock. Short Call Expires In The Money.

From accessibleinvestor.com

What is a covered call? [Infographic] Accessible Investor Short Call Expires In The Money American style options (etfs and equities) are settled via. When running this strategy, you want the call you sell to expire worthless. Web suppose an investor purchases a call option that is 13% out of the money and expires in one year for 3% of the value of the. A call option 5 gives the. No transference of stock takes. Short Call Expires In The Money.

From estably.com

Short Call Optionsstrategie einfach erklärt Short Call Expires In The Money Web in the money or out of the money? American style options (etfs and equities) are settled via. No transference of stock takes place. The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. When running this strategy, you want the call you sell to expire worthless. Web selling. Short Call Expires In The Money.

From workplace.schwab.com

The Short Option A Primer on Selling Options Retirement Plan Services Short Call Expires In The Money A call option 5 gives the. Web selling the call obligates you to sell stock at strike price a if the option is assigned. When running this strategy, you want the call you sell to expire worthless. American style options (etfs and equities) are settled via. Web in the money or out of the money? No transference of stock takes. Short Call Expires In The Money.

From wixequj.web.fc2.com

Call option payoffs effective indicator binary options strategy Short Call Expires In The Money Web in the money or out of the money? The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. When running this strategy, you want the call you sell to expire worthless. Web suppose an investor purchases a call option that is 13% out of the money and expires. Short Call Expires In The Money.

From indetecagua.com

What Happens If Covered Call Expires In The Money How To Read A Forex Short Call Expires In The Money When running this strategy, you want the call you sell to expire worthless. No transference of stock takes place. American style options (etfs and equities) are settled via. A call option 5 gives the. Web a short call is an options trading strategy that involves a trader selling (or writing) a call option with the expectation that the price of. Short Call Expires In The Money.

From laptrinhx.com

Short Call Option Payoff Graph LaptrinhX Short Call Expires In The Money A call option 5 gives the. When running this strategy, you want the call you sell to expire worthless. No transference of stock takes place. Web selling the call obligates you to sell stock at strike price a if the option is assigned. Web a short call is an options trading strategy that involves a trader selling (or writing) a. Short Call Expires In The Money.

From www.adigitalblogger.com

Short call Options Strategy, Payoff, Graph, Risk, Profit, Example Short Call Expires In The Money The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. American style options (etfs and equities) are settled via. A call option 5 gives the. Web suppose an investor purchases a call option that is 13% out of the money and expires in one year for 3% of the. Short Call Expires In The Money.

From analystprep.com

Determining the Value at Expiration and Profit from a Long or a Short Short Call Expires In The Money American style options (etfs and equities) are settled via. Web suppose an investor purchases a call option that is 13% out of the money and expires in one year for 3% of the value of the. When running this strategy, you want the call you sell to expire worthless. No transference of stock takes place. A call option 5 gives. Short Call Expires In The Money.

From www.youtube.com

What Happens When A Covered Call Expires Out Of The Money Webull Short Call Expires In The Money Web suppose an investor purchases a call option that is 13% out of the money and expires in one year for 3% of the value of the. No transference of stock takes place. The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. Web a short call is an. Short Call Expires In The Money.

From www.newtraderu.com

Covered Calls for Beginners (Options Trading Strategy Guide) New Trader U Short Call Expires In The Money Web a short call is an options trading strategy that involves a trader selling (or writing) a call option with the expectation that the price of the underlying asset will. The buyer (owner) of an option has the right, but not the obligation, to exercise the option on or before expiration. Web suppose an investor purchases a call option that. Short Call Expires In The Money.

From www.investopedia.com

What Is Call Money (aka Money at Call) in Lending and Banking? Short Call Expires In The Money Web selling the call obligates you to sell stock at strike price a if the option is assigned. No transference of stock takes place. Web a short call is an options trading strategy that involves a trader selling (or writing) a call option with the expectation that the price of the underlying asset will. A call option 5 gives the.. Short Call Expires In The Money.

From www.optiontradingtips.com

Understanding Option Payoff Charts Short Call Expires In The Money American style options (etfs and equities) are settled via. Web selling the call obligates you to sell stock at strike price a if the option is assigned. Web in the money or out of the money? No transference of stock takes place. A call option 5 gives the. Web a short call is an options trading strategy that involves a. Short Call Expires In The Money.

From www.adigitalblogger.com

Short Call Vs Short Call Butterfly Options Trading Strategies Comparison Short Call Expires In The Money Web selling the call obligates you to sell stock at strike price a if the option is assigned. Web suppose an investor purchases a call option that is 13% out of the money and expires in one year for 3% of the value of the. A call option 5 gives the. The buyer (owner) of an option has the right,. Short Call Expires In The Money.